As much as you love your children and would like to think they will be caring and unselfish when you’re not there to referee, this is the time to be realistic. If they really don’t get along, or if there could be jealousies, you and your family will be much better off with a professional as your successor trustee. The fee they charge is a small price to pay if it keeps peace in your family.

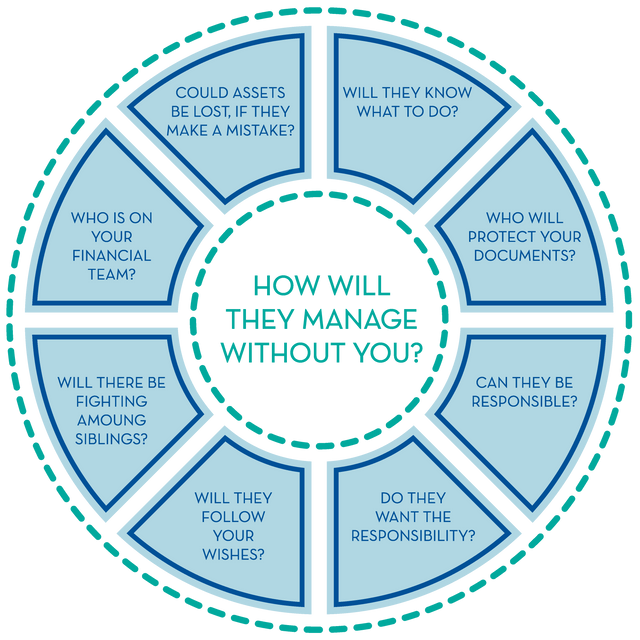

The purpose of this page is to help you consider all the factors in choosing a responsible person that will carry out your wishes without regard to family pressure and will carry out all tasks to the highest standards.

Don’t forget that you can name as many contingent individuals as you want. It costs nothing to add a professional fiduciary last. You should always have a backup plan.

Call NowObjectivity and the ability to follow the trust document instructions will mean less court involvement, lower costs, and fewer unresolved disputes between your beneficiaries.

At any time you choose, your Trustee can take over your bill-paying, arrange for additional help for you, and look after other responsibilities you designate. Trust administration can be time-consuming and fraught with difficulties. Financial transactions must be handled in a timely fashion. Beneficiaries must be kept informed to reduce fear and conflict. Decisions must be made and thoroughly documented (for as long as three years) after a loved one’s death.

Trust documents and Health Care directives can protect you, your spouse, and loved ones from disagreements and conflicts of interest. Making decisions NOW can bring peace and family harmony.

With an experienced trustee to take care of your daily worries, you can enjoy a greater quality of life. The trustee applies certain basic skills and knowledge; financial, legal, medical, trust accounting principles, a fair and objective point of view, knowledge of the probate code and tax laws, accurate and complete documentation, and time to do the work. Objective communication with every person involved with the trust is critical to success.

Your trust document can be complex with detailed instructions. You may want certain decisions to be at the discretion of an experienced trustee.

Your trustee will have an understanding of your plans and desires and have a safe place to keep your documents.

The team needed for a good Estate Plan includes the professionals you already know and trust. Your trustee should have a list of all the current members of your team, like your attorney, CPA, and financial planner, along with any relevant documents. The professional trustee develops relationships with additional professionals as needed. Consistent, calm communication and integrity keep the intent of the trust protected. Your trustee keeps you informed and implements YOUR decisions.

Some investments can lose value if unsupervised. Some of the institutions, in which you are invested, need to be reviewed regularly. Some decisions can have severe tax consequences. Precious family heirlooms need to be identified and protected for the future. An experienced team, sworn to a code of ethics, can provide asset protection and good planning for the long-term benefit of the family.

When selecting a trustee, one of the most important considerations is how much the fiduciary will charge for their services. Trustee fees in California can vary widely depending on the complexity of the trust, the value of the estate, and the fiduciary capacity in which the trustee is acting. Generally, fiduciary fees are considered reasonable compensation for the time, expertise, and risk involved in trust administration. Whether you’re working with a professional trustee or an individual serving in a fiduciary capacity, it’s essential to understand the trustee fee schedule and what services are included.

So, how much does a fiduciary cost? The answer depends on the specific duties required. Many professional fiduciaries follow a standard trust administration fees schedule, while others charge hourly rates or a percentage of the trust assets. At Advocate Fiduciary, we are transparent about our fees and ensure our clients have a clear understanding of what fiduciary fees cover—from asset management to bill payment and beneficiary communication. For a detailed look at our fiduciary rates, please see our Trustee Fee Schedule. Knowing how much fiduciaries charge can help families plan effectively and ensure that trust assets are managed with care and accountability.